Hard Fork Explained: What It Is and How It Works

What is a Hard Fork?

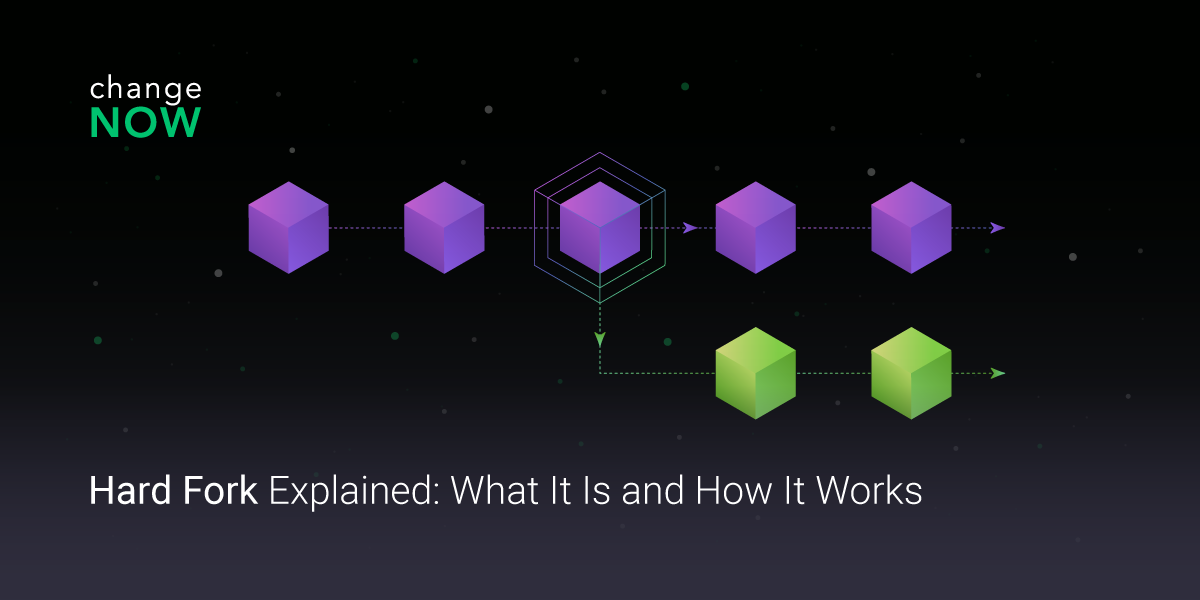

A hard fork refers to a significant and permanent divergence in the blockchain protocol of a cryptocurrency. It occurs when developers implement a radical change to the existing rules and structure of a blockchain network. This change creates a new version of the blockchain that is incompatible with the previous version.

The term "hard fork" is derived from the image of a fork in a road, where the blockchain splits into two separate paths. Each path follows its own set of rules and protocols, resulting in the formation of two distinct cryptocurrencies.

Forks in Blockchain

To understand hard forks, it is essential to comprehend the concept of forks in blockchain technology. A fork occurs when the blockchain network splits into two separate paths, resulting in the creation of two distinct versions of the blockchain.

Forks can be categorized into two types: hard forks and soft forks. While hard forks result in the creation of a new and incompatible blockchain, soft forks introduce backward-compatible updates to the existing blockchain.

How Hard Forks Work

During a hard fork, developers propose changes to the existing blockchain protocol. These changes can include modifications to the consensus mechanism, block size limits, transaction validation rules, or any other aspect of the blockchain's functionality.

Once the proposed changes are implemented, two versions of the blockchain coexist. Nodes that have adopted the new protocol continue to validate and propagate transactions according to the updated rules, while nodes that have not upgraded remain on the old protocol.

This divergence in protocols creates a split in the blockchain, leading to the formation of two separate cryptocurrencies. Holders of the original cryptocurrency receive an equivalent amount of the new cryptocurrency, reflecting the state of the blockchain at the time of the hard fork.

Differences Between Hard Forks and Soft Forks

The main difference between hard forks and soft forks lies in their compatibility with the existing blockchain. Hard forks create a permanent split, resulting in two distinct blockchains that are incompatible with each other. On the other hand, soft forks maintain backward compatibility, allowing nodes operating on the old protocol to continue participating in the network.

Another crucial distinction is the level of consensus required. Hard forks necessitate a majority of the network's hash power to adopt the new protocol, while soft forks only require a majority of the hash power to validate blocks according to the new rules.

Notable Historical Hard Forks

Bitcoin Improvement Proposal 91 (BIP 91)

One of the most significant hard forks in the history of cryptocurrency is the implementation of Bitcoin Improvement Proposal 91 (BIP 91) in 2017. BIP 91 aimed to resolve the scalability issue faced by the Bitcoin network by activating the Segregated Witness (SegWit) upgrade.

The activation of BIP 91 required a significant majority of miners to signal their support for the proposal. Once this threshold was reached, the SegWit upgrade was activated, enhancing the network's capacity to process a higher volume of transactions.

The DAO Heist

Another notable hard fork event occurred in 2016, involving the Ethereum network. The Decentralized Autonomous Organization (DAO), a smart contract-based investment fund built on the Ethereum blockchain, was hacked, resulting in the theft of millions of Ether (ETH).

In response to this security breach, the Ethereum community conducted a hard fork to reverse the unauthorized transactions and return the stolen funds to their rightful owners. This hard fork led to the creation of two separate blockchains: Ethereum (ETH) and Ethereum Classic (ETC).

Impact of Hard Forks on Cryptocurrencies

Hard forks often have a significant impact on the price volatility of cryptocurrencies. The announcement and anticipation of a hard fork can lead to increased market speculation and trading activity. Traders and investors may buy or sell cryptocurrencies in anticipation of receiving new coins from the hard fork or to take advantage of potential price fluctuations.

After a hard fork, the price of the original cryptocurrency and the newly created cryptocurrency may experience significant fluctuations. Factors such as market sentiment, community support, and the perceived value of the new cryptocurrency can influence the price dynamics.

Creation of New Cryptocurrencies

One of the primary outcomes of a hard fork is the creation of a new cryptocurrency. Holders of the original cryptocurrency receive an equivalent amount of the new cryptocurrency, reflecting the state of the blockchain at the time of the hard fork.

The new cryptocurrency may have distinct features, functionalities, or improved scalability compared to the original cryptocurrency. It may also provide an opportunity for developers and users to experiment with different blockchain protocols and governance structures.

Community Divisions

Hard forks can lead to divisions within the cryptocurrency community. Supporters of the original blockchain may choose to remain on the old protocol, while others may migrate to the new blockchain. These divisions can result in debates, disagreements, and the formation of separate communities with different visions and objectives.

However, it is worth noting that hard forks can also foster innovation and competition within the cryptocurrency ecosystem. The existence of multiple blockchain networks encourages developers to explore new ideas, experiment with different consensus algorithms, and improve upon existing protocols.

Examples of Hard Forks

Bitcoin Cash (BCH)

Bitcoin Cash (BCH) is a prominent example of a hard fork that occurred within the Bitcoin network. It was created in 2017 to address scalability issues and increase the block size limit from 1MB to 8MB.

The hard fork resulted in the formation of two separate blockchains: Bitcoin (BTC) and Bitcoin Cash (BCH). Bitcoin Cash aimed to provide faster transaction processing times and lower transaction fees compared to Bitcoin.

Ethereum Classic (ETC)

Ethereum Classic (ETC) emerged as a result of the hard fork that occurred after the DAO hack in 2016. While the majority of the Ethereum community supported the hard fork to reverse the unauthorized transactions, a minority chose to remain on the original blockchain, which became Ethereum Classic.

Ethereum Classic continues to operate on the pre-fork blockchain, upholding the principles of decentralization and immutability. It serves as an alternative version of Ethereum, offering developers and users different options for building and utilizing smart contracts.

Conclusion

Hard forks are a fascinating aspect of the cryptocurrency world, enabling the creation of new blockchains and cryptocurrencies. They can have a significant impact on the market, causing price volatility and community divisions. Understanding the mechanics and implications of hard forks is essential for anyone interested in cryptocurrencies.

As the cryptocurrency ecosystem continues to evolve, it is crucial to stay informed and adapt to changes. Whether you are a trader, investor, or enthusiast, keeping up with the latest developments in hard forks and other blockchain events can help you navigate the ever-changing landscape of cryptocurrencies.

Exchange Crypto on ChangeNOW

Ready to explore the world of cryptocurrencies? Exchange your crypto assets hassle-free on ChangeNOW, the best crypto exchange. With its user-friendly platform, competitive exchange rates, and exceptional customer support, ChangeNOW makes it easy for anyone to buy, sell, or swap crypto. Visit ChangeNOW now to experience the seamless exchange process without the need for an account or registration.